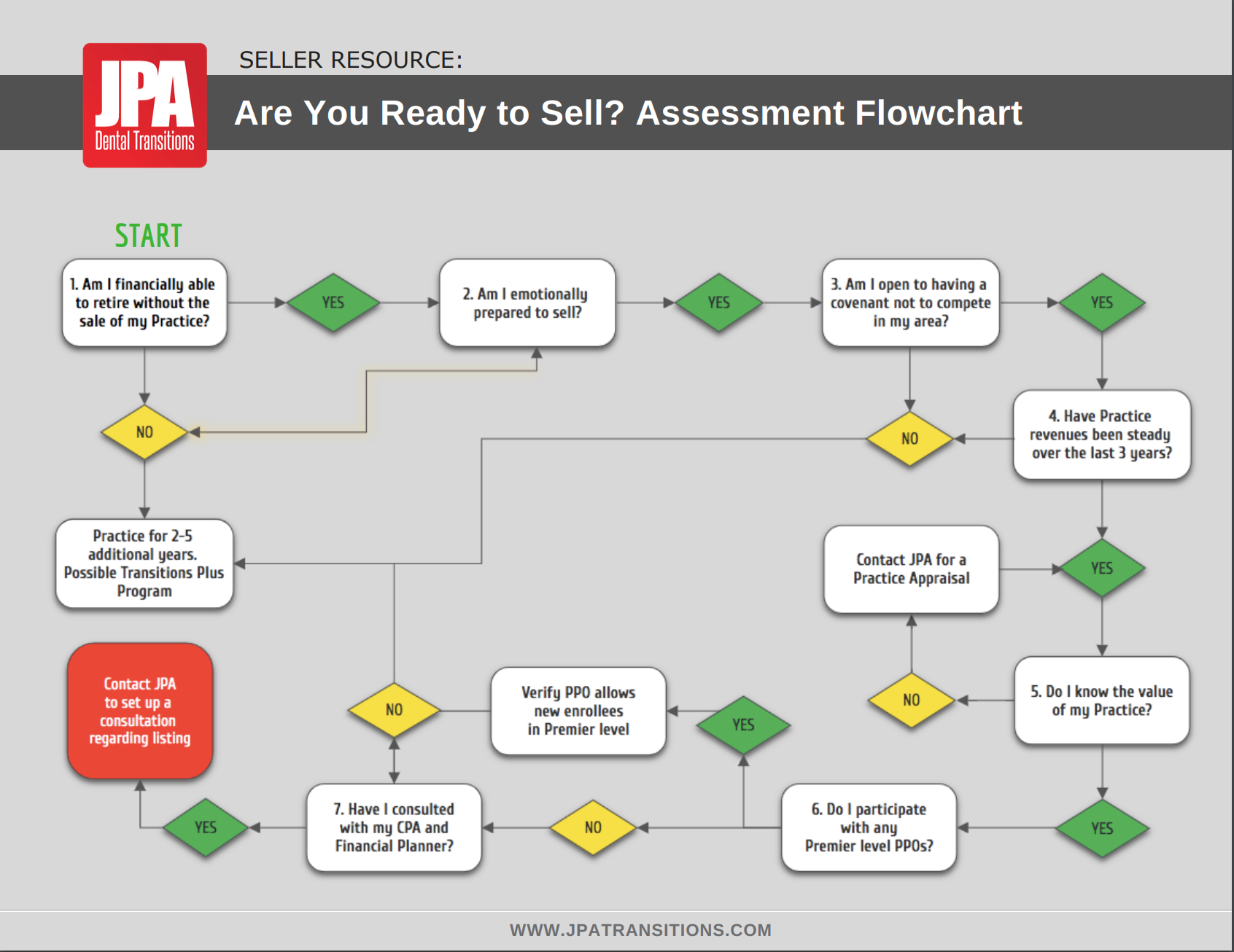

Selling your dental practice is an emotional journey. You’ve invested a lot of time and money into your career, and now you’re stepping away from that into unfamiliar territory. There are many things that play a role in determining if you are ready to sell your practice, financials, legal hoops, revenue, emotions, and countless other eventualities. While you cannot foresee every hurdle in the process, having a knowledgeable and experienced team that has walked this road before, is a major advantage in de-mystifying any twists and turns that you encounter. So, are you ready to sell your dental practice? Let's find out.

Download the above image and other dental resources to your computer.

Before we start, keep it private.

One of the biggest mistakes that sellers make is discussing their plans with non-advisors. This can often leak the news to staff or even patients. When this happens, the threat of losing patients, and thus losing revenue and undermining the value of your practice becomes very real. This can also introduce the potential of losing valuable staff members, no one likes the unknown, and staff will often favor leaving the practice to find a new employer then waiting to see how the sell plays out. The knowledge of an impending sell should be kept to your professional advisors (CPAs, retirement planner, transition broker, lawyer, etc.), and your spouse or closest confidant for moral support. (Related blog: How to Get the Information You Need While Maintaining Confidentiality.)

Am I financially able to retire without the sale of my practice?

It is common to assume that you will take the money from the sale of your practice and use it toward retirement. Your practice is your largest asset, why wouldn’t you get a large return? This is a mindset that may cause issues. Your practice may not be worth as much as you think. At the end of the day, it’s not about the value of the practice, but about the amount of money you take home. However, before we start talking about the value of your practice, we need to ensure that you have the proper retirement plans in place. If you are able to retire without the sale of your practice, you are in a great spot. If you’re not ready right now, we recommend practicing for another 2-3 years.

Am I emotionally prepared to sell my practice?

You’ve built a strong relationship with your staff, they’re your second family. That’s why selling your practice to someone you can trust becomes so important. Our clients are often surprised by the emotional toll it takes on them. Ask yourself a few questions before you decide to sell your dental practice:

- Are you ready to no longer be an owner?

- What are you looking for in a buyer?

- Can you say “yes” to a deal if a qualified buyer is found?

Think long and hard about these questions to make sure that you are emotionally ready to sell. If you are still having doubts, give yourself a little more time and re-visit in 6 months.

Am I open to having a non-compete in my area?

When you sell your practice, the buyer may decide to have a non-compete agreement drawn up. This means that as the seller, you could be asked to sign an agreement that states that you will not open a competing dental practice (or practice) within a specified distance of the practice for a for a given period of time. This agreement may impact your post-sale plans. If you plan to practice after the sale, you will need to be aware of the potential of a non-compete and be sure you are abiding by the rules it establishes. If you are planning on retirement, this should not pose any issues. Some selling doctors also choose to stay on with the purchasing doctor for a period of time, working abbreviated schedules (this would all be worked out prior to closing).

Have practice revenues been steady for the past 3 years?

If they’ve been steady and increasing, great! Your practice revenues should be never be trending down. Maintaining a steady increase leading up to the sale or at least maintaining revenues is extremely important to the value of your practice. Why? With any large business transaction, you want to have an attractive and valuable offer rather than a practice with unpredictable (or even negative) growth or questionable trends. This makes a buyer second guess their investment. Pay attention to the most recent year’s revenue and maintain or increase the production leading up to the sale.

Often, we see that doctors want to take vacations or time off in the years before they sell. This is perfectly fine, but make sure your practice revenues do not slip. Sometimes, doctors get into the “sellers mindset”, seeing retirement on the horizon, they stop pushing to grow their practice. It is very important that you do not let this happen. You must continue to work diligently on, and in, your practice until the day the sale is complete.

If your numbers haven’t been trending well, contact us about our Transitions Plus Program, and we can help you get your practice back to its full potential.

Do I know the value of my practice?

You need to have a benchmark in order to improve your dental practice’s value. Knowing what is transpiring and how to fix any arising issues is a critical piece of growing your practice. If you don’t know the value of your practice, that’s okay. We can help you! Contact us for your very own practice appraisal.

Do I have my personal finances in order?

Just like preparing for retirement, your personal finances are just as important. Keeping track of your personal expenses can help you calculate your overall living expenses in a year, which will be important when it comes to retirement.

After you’ve calculated what you’re spending for a year, follow these quick tips for getting your finances together:

- Meet with your CPA and Retirement Planner

- Create a document with your assets and liabilities.

- Make a plan with your financial advisor to pay off all debt (personal and business debt).

- Meet with your broker to calculate your practice value.

- If you own your building, get a commercial appraisal.

- Meet with your financial advisor to discuss if you have enough money to retire or you’ll have to find work after you sell.

Related blog:

Blog: Selling your dental practice? Pay off debt first

Have I consulted with my CPA and financial planner?

Once you have decided to sell, it is time to let your financial advisors know and to get the rest of your transitions team together. This team should include but is not limited to: a CPA, financial advisor, practice transition company, and attorney. Consulting your team is important because they are your experts, the ones who will have your back, ensure that you are meeting all deadlines, and make your practice sale a success. If you don’t know where to start or don’t have a team, feel free to reach out to us and we can help put one together for you!

What’s next? If you're ready to sell your practice, contact a dental transition company.

Your next best step is to set up a consultation. At JPA, we’ve worked with many sellers and buyers in our careers. If you’re looking at transitioning out of ownership and want to know the steps you need to take, feel free to reach out to anyone on our team or, download our free transition prep tools that will help you along the process.

980.283.7355

980.283.7355

Comment